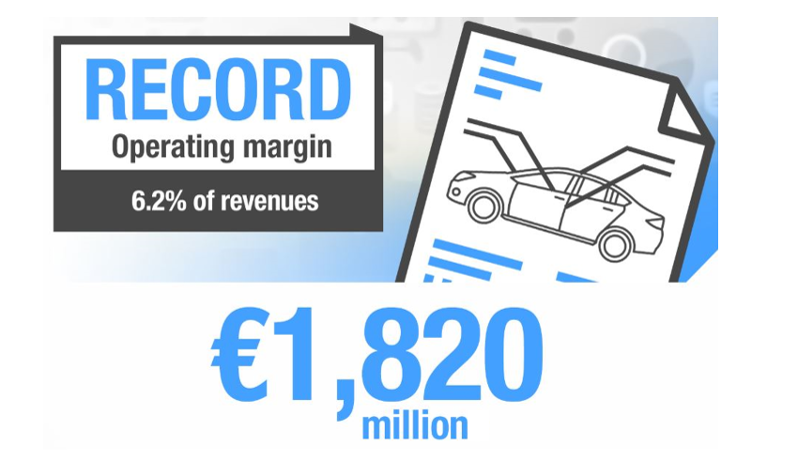

1/ These record-breaking half-year results showcase once again the Group's strong health

Can you give more details on the key points for the first half?

First, these great results come from a strong growth in volume within all of the Regions.

The European market was once again more dynamic than expected, and within it only the British market showed some signs of weakness.

Our activities outside Europe continued to drive our growth, with a 16.8% increase in registrations over the first half.

Every Region outside Europe displayed strong sales results. The Asia-Pacific Region showed the most significant growth due to the recent launches of Kadjar and New Koleos in China, and to the successful launches of QM6 and SM6 in South Korea. The America and Eurasia Regions have also demonstrated great performance thanks to the first signs of recovery in the Brazilian and Russian markets.

Additionally, sales to partners have contributed to the growth of our revenues, with the launch of the Nissan Micra production in our Flins plant.

As for profitability, cost reductions have been significant over the first half despite an increase in R&D expenses to prepare for the new vehicles of the future. Purchasing also showed good results, and was able to take full advantage of the Alliance synergies.

RCI Bank and services also contributed to this improvement in the group's margins with record-breaking results thanks to its sales dynamic and its sound risk management.

Negative aspects included raw materials, which saw an increase in prices compared to last year, mainly due to the rising cost of steel. The currency effect, even though there was a significant improvement from last year, was still negative this half, due in particular to the depreciation of the British pound.

In conclusion, these are good results, and they testify to the hard work and commitment of the group's employees over the last few years.

2/ What risks and opportunities have you identified for the second half?

We are confident in the second half, but as always, there are risks and opportunities.

First, the sales momentum should continue with the gradual rebound expected for the Brazilian and Russian markets. In addition, the product activity should be strong in Latin America with the launch of the SUV range including Kwid, Captur and New Koleos, and with the continued sales of the pick-up Alaskan.

Our cost reduction objectives should move forward as well, with good results expected for purchasing.

Regarding risks, we must stress the significant volatility of currencies. The euro recently strongly increased, and emerging market currencies have overall been hit hard these past few weeks. We will need to pay particular attention to this over the second half, as well as to the changes in raw materials prices.

3/ AVTOVAZ recorded a positive operating margin this half, even though last year it was clearly in the red. How do you explain this bounce back? And what are your expectations for the coming quarters?

This is obviously a positive point, and a first step in AVTOVAZ's recovery.

We are starting to see the results of the significant efforts these past few years to reduce the cost base and improve productivity in our plants. The sales dynamic has also improved with the rebound of the Russian market and the success of the new models launched in 2016 (Lada Vesta and XRay).

And don’t forget the impact of the rouble, which evolved positively for a large part of the first half, and which greatly helped to improve results.

However, there's still much to be done in the coming quarters, against a resolutely volatile backdrop. AVTOVAZ should continue its efforts to improve localisation, to adopt the industrial standards of the Renault-Nissan Alliance, to upgrade its range, and to sustain this return to a positive operating margin.